Nvidia vs. Microsoft: Who’s Really Leading, and What Should You Do With NVDA Stock Now?

In the ongoing tech stock showdown, Nvidia (NASDAQ: NVDA) briefly surpassed Microsoft (NASDAQ: MSFT) last week to become the world’s most valuable company by market cap. Though Microsoft has since reclaimed the top spot, it’s clear the battle for tech dominance is far from over — and Nvidia remains a top contender.

NVDA Shares Surge: Is It Time to Buy?

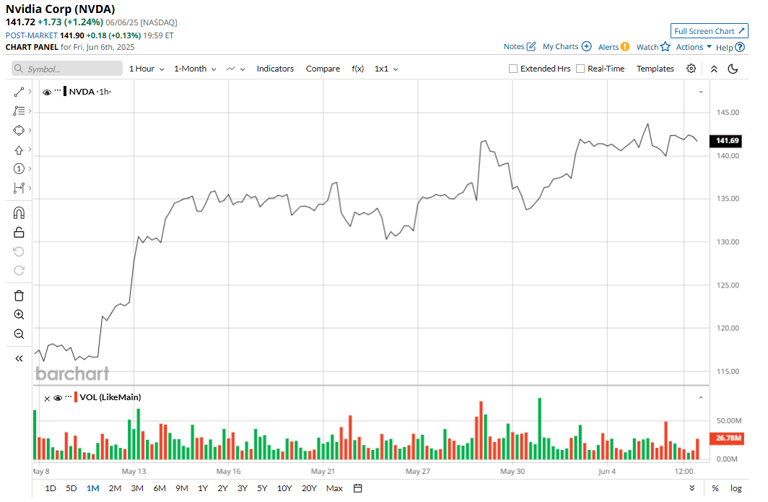

Nvidia stock has skyrocketed more than 22% in the past month, rebounding strongly after a brief pullback post-earnings. So the big question is: should you add (or keep adding) Nvidia stock to your portfolio?

From where we stand, the answer is a confident yes. Here’s why.

Nvidia’s Financials: Still Unmatched

Nvidia continues to deliver record-breaking numbers. In fiscal Q1 2026, the company posted $44.1 billion in revenue — a stunning 69% increase year-over-year. Its data center segment alone contributed $39.1 billion, up 73%.

EPS came in at $0.81, beating analyst expectations of $0.75. And for the current quarter, analysts are projecting $0.94 EPS on $45.59 billion in revenue.

While gross margins declined to 61% from last year’s 78.9%, Nvidia still commands a staggering 92% share of the GPU market, easing concerns over competitive threats. Management also reiterated a gross margin target in the mid-70s by year’s end.

Operating cash flow surged 79% to $27.4 billion, and the company ended the quarter with a cash reserve of $53.7 billion — and zero short-term debt. In short, Nvidia remains financially bulletproof.

AI Leadership: Nvidia’s Real Moat

Nvidia’s dominance in AI is unrivaled. It powers major hyperscalers like Microsoft, Amazon (NASDAQ: AMZN), and Google (NASDAQ: GOOG), and its Blackwell GPU architecture is ramping faster than any in company history.

CFO Colette Kress noted that leading cloud providers are deploying around 72,000 Blackwell GPUs every week, accelerating Nvidia’s AI data center momentum. The flagship GB200 NVL72 rack, built around these next-gen chips, is driving this growth.

China also delivered a silver lining. Inventory write-downs totaled $4.5 billion — less than the expected $5.5 billion — and Nvidia is reportedly preparing a Blackwell-based “B30” GPU variant designed for compliance with export controls.

Looking forward, Nvidia sees massive opportunities in sovereign AI, enterprise AI, and robotics. Global demand for AI infrastructure is surging, and governments across regions — from Canada to Saudi Arabia to Japan — are actively partnering with Nvidia on national AI initiatives.

Enterprise Momentum & Platform Expansion

Beyond hardware, Nvidia is scaling its software and platform business. Its RTX PRO Servers, DGX Spark, and DGX Station are powering enterprise AI adoption. Partnerships with Dell (NYSE: DELL) and HPE (NYSE: HPE) are helping enterprises build next-gen data platforms.

Meanwhile, Nvidia’s Omniverse — a suite of 3D SDKs and microservices — is gaining traction for industrial and digital transformation, with Accenture (NYSE: ACN) leading integration efforts.

Nvidia is also positioning itself for the next wave of agentic AI, AI inference, and high-performance networking — areas that will drive future growth beyond the traditional GPU market.

Sampling of the upcoming Blackwell Ultra GB300 began in May, with initial shipments due by the end of Q2. These new GPUs will boost memory and performance significantly, making them a key growth catalyst into 2025.

Wall Street’s View: Strong Buy on NVDA Stock

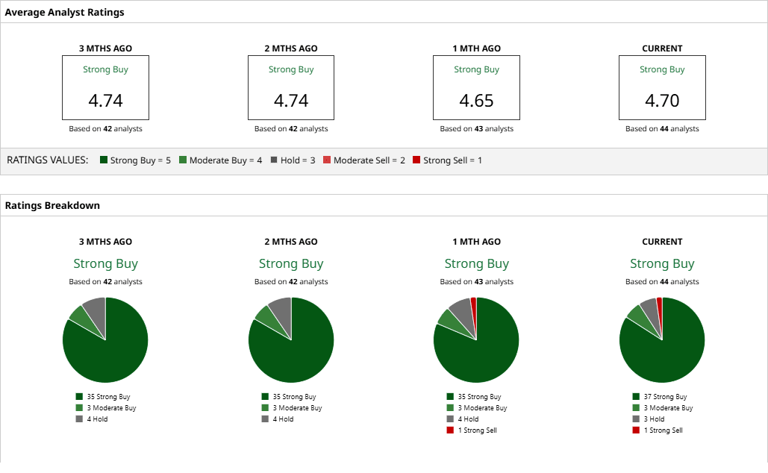

Analysts are overwhelmingly bullish. NVDA currently holds a “Strong Buy” rating, with a consensus price target of $173.88 — suggesting about 22% upside from current levels.

Out of 44 analysts:

- 37 rate NVDA a “Strong Buy”

- 3 rate it a “Moderate Buy”

- 3 rate it a “Hold”

- Only 1 sees it as a “Strong Sell”

Bottom Line: Nvidia Remains a Top AI Stock to Own

Despite the tight race with Microsoft, Nvidia is in a class of its own. Its unmatched position in AI infrastructure, enormous cash reserves, accelerating product roadmap, and global partnerships make it one of the most compelling tech investments today.

If you’re looking for long-term exposure to AI, data centers, and enterprise compute — Nvidia stock remains a buy.